Seller Financing: The Legal Risks and Rewards

1 May 2025

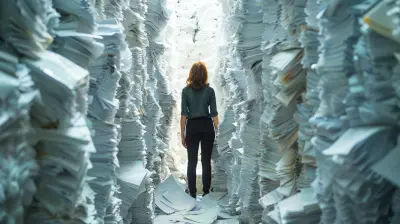

Buying or selling a home is one of the biggest financial moves most people make in their lifetime. While traditional bank loans are the go-to option for buyers, seller financing is an alternative that can be beneficial for both parties—when done the right way.

As appealing as it may sound, there are legal risks and rewards tied to seller financing. If you're thinking about using this method, understanding what you're getting into is crucial. So, let’s break it down in simple terms.

What Is Seller Financing?

Seller financing, also known as owner financing, is when the seller acts as the lender instead of a traditional bank. Instead of the buyer securing a mortgage from a financial institution, they make payments directly to the seller over time.In essence, the seller provides the financing, and both parties agree on the terms, including the interest rate, repayment schedule, and consequences if the buyer defaults.

It can be a win-win situation, but just like any financial transaction, it comes with its own set of pros and cons.

The Rewards of Seller Financing

Before we dive into the risks, let’s look at why seller financing can be a great option for both buyers and sellers.1. Faster Sales Process

Traditional mortgage approvals can take weeks or even months. Seller financing eliminates the hassle of dealing with banks, making the process much faster. Once the buyer and seller agree on the terms, the deal can close in days instead of weeks.2. Higher Selling Price

Sellers offering financing can often justify a higher asking price. Why? Because they're providing a solution that many buyers can’t get from a bank. Buyers who struggle with traditional financing might be willing to pay more for the opportunity to purchase a home on seller-financed terms.3. Attracting More Buyers

Many potential homeowners get rejected by banks due to credit history issues, self-employment income, or other financial hiccups. Seller financing opens doors for these buyers, expanding the pool of potential purchasers.4. Ongoing Income Stream for Sellers

Instead of receiving a lump sum, the seller gets continuous monthly payments, creating a passive income stream. With interest rates set by the seller, this can be a profitable long-term investment.5. Potential Tax Benefits

Receiving payments over time rather than a lump sum may allow sellers to spread out capital gains taxes. This could reduce their overall tax burden compared to receiving the full amount upfront from a traditional sale.6. Flexible Terms

Unlike rigid bank terms, seller financing allows for flexible terms that suit both parties. Interest rates, down payments, and repayment schedules can all be negotiated to meet everyone’s needs.

The Legal Risks of Seller Financing

While the rewards sound enticing, seller financing isn’t without its dangers. Legal missteps can turn a good deal into a nightmare. Here’s what you need to be aware of before going down this path.1. Default Risks

One of the biggest risks is that the buyer may stop making payments. If they default, the seller must go through a foreclosure or legal eviction process to reclaim the property. This can be costly, time-consuming, and stressful.To minimize this risk, sellers should:

- Require a reasonable down payment to ensure the buyer has skin in the game.

- Conduct thorough background checks, including reviewing credit history.

- Outline clear default consequences in the contract.

2. Due-on-Sale Clause in Existing Mortgages

If the property still has an outstanding mortgage, seller financing could trigger the lender’s due-on-sale clause. This means the bank can demand full repayment of the loan immediately—something most sellers aren’t prepared for.To avoid this issue, sellers should check with their lender before agreeing to a seller-financed deal.

3. Legal and Compliance Issues

Real estate laws vary by state, and seller financing is a heavily regulated area. Many laws exist to protect buyers from predatory lending. Sellers need to ensure they comply with:- Dodd-Frank Act, which regulates mortgage lending practices.

- Usury laws, which set limits on interest rates.

- State-specific regulations, which may require licensing to offer financing.

Failing to follow these laws can result in hefty fines—or worse, an invalid contract. Consulting a real estate attorney is a must.

4. Risk of Buyer Damage to Property

Since legal ownership remains with the seller until full payment is made, a careless or destructive buyer could significantly damage the property. If the deal falls through, the seller might be left with a home in worse condition than when they sold it.Including clauses in the contract that require property upkeep and regular inspections can help mitigate this risk.

5. Difficulty in Reselling the Loan

In traditional lending, banks often resell mortgages. With seller financing, the seller holds the loan, making it harder to liquidate the asset if they need immediate cash.Some sellers do sell their owner-financed notes to investors, but this usually means taking a discount on the remaining balance.

6. Balloon Payments Can Cause Trouble

Many seller-financed deals include a balloon payment, where the buyer makes smaller monthly payments for a few years, then must pay off the remaining balance in one large sum. If the buyer can’t secure financing for the balloon payment, they might default, causing issues for the seller.To prevent this, sellers should:

- Ensure buyers have a reasonable plan to secure financing before the balloon payment comes due.

- Consider structuring the loan with fully amortized payments instead of a large lump sum.

Tips for Safer Seller Financing

If you’re considering seller financing, here are some ways to mitigate risks and maximize rewards:✅ Hire a Real Estate Attorney – They can draft a solid contract that protects both parties.

✅ Vet the Buyer Thoroughly – Look at credit scores, job stability, and financial history.

✅ Require a Down Payment – A higher down payment encourages buyer commitment.

✅ Use a Licensed Loan Servicer – They can handle payment collection and recordkeeping.

✅ Document Everything – Keep a record of payments, agreements, and correspondence.

✅ Follow State and Federal Laws – Ensure compliance with all regulations to avoid legal trouble.

Final Thoughts

Seller financing is a powerful tool in real estate, but it’s not for everyone. While it offers flexibility, a faster selling process, and potential financial gains, the risks—especially legal ones—are real.If you’re a seller, going into this without proper legal knowledge or failing to vet buyers can lead to financial losses and legal headaches. If you’re a buyer, make sure you understand the terms fully before signing anything.

As with any financial decision, getting expert advice from a real estate attorney or financial advisor is always a smart move. Seller financing can be a rewarding experience—but only when done the right way.

all images in this post were generated using AI tools

Category:

Real Estate LawsAuthor:

Cynthia Wilkins

Discussion

rate this article

7 comments

Helen McMichael

Seller financing offers flexibility but requires careful legal consideration.

May 10, 2025 at 11:24 AM

Cynthia Wilkins

Absolutely, careful legal consideration is essential to navigate the complexities of seller financing while maximizing its benefits.

Zora Wilkins

Seller financing can be a double-edged sword; while it offers flexibility and a competitive edge in attracting buyers, it also exposes sellers to legal risks, including potential defaults and regulatory compliance issues.

May 8, 2025 at 6:29 PM

Cynthia Wilkins

Thank you for your insightful comment! You're right—seller financing provides unique opportunities but also carries significant risks that require careful consideration and proper legal guidance.

Corin Jordan

Seller financing can offer flexibility and opportunities, but careful navigation of legal risks is essential for both parties' protection.

May 8, 2025 at 3:51 AM

Cynthia Wilkins

Thank you for your insightful comment! Indeed, while seller financing presents unique opportunities, understanding and addressing the legal risks is crucial for ensuring a fair and secure transaction for all involved.

Nora West

Seller financing offers unique opportunities for buyers and sellers, but it's crucial to understand the associated legal risks and rewards to make informed decisions.

May 4, 2025 at 8:47 PM

Cynthia Wilkins

Absolutely, understanding the legal aspects is essential for both parties to navigate the benefits and potential pitfalls of seller financing effectively.

Zephyrian Baker

Understand risks before pursuing seller financing.

May 4, 2025 at 12:26 PM

Cynthia Wilkins

Absolutely! Understanding the potential risks is crucial to making informed decisions in seller financing. Always conduct thorough research and seek professional advice.

Theodore Walker

Seller financing can be a beneficial option for buyers and sellers, but it's crucial to understand the associated legal risks. Proper documentation and legal advice are essential to navigate potential pitfalls while maximizing rewards in this arrangement.

May 3, 2025 at 12:04 PM

Cynthia Wilkins

Thank you for your insight! You're absolutely right—understanding legal risks and securing proper documentation are vital for a successful seller financing arrangement.

Haven Banks

Great insights! Seller financing can be tricky!

May 3, 2025 at 3:58 AM

Cynthia Wilkins

Thank you! Absolutely, navigating seller financing requires careful consideration of the legal aspects.

MORE POSTS

Breaking Down Contingency Deadlines in Real Estate Agreements

Real Estate Agent Etiquette: What Buyers and Sellers Need to Know

The Role of Home Appraisals in a Successful Sale for First-Time Sellers

Simplifying the Paperwork Process for First-Time Sellers

The Importance of Online Listings for FSBO Success

Selling Your Home After a Divorce: Essential Tips