Blackstone Secures $8 Billion for New Real Estate Debt Fund

March 18, 2025 - 03:43

Blackstone has successfully finalized the closing of its latest real estate debt fund, known as Blackstone Real Estate Debt Strategies V (BREDS V). This new fund has garnered an impressive total of approximately $8 billion in capital commitments, marking a significant milestone for the firm in the real estate sector.

The BREDS V fund aims to capitalize on various investment opportunities in the real estate market, focusing on debt strategies that can yield attractive returns. With the ongoing fluctuations in the real estate landscape, Blackstone's strategic approach is designed to navigate the complexities of the market while providing investors with a robust platform for growth.

The firm’s ability to raise such substantial capital underscores investor confidence in its expertise and track record in real estate investments. As the market continues to evolve, Blackstone's BREDS V is positioned to play a pivotal role in addressing the financing needs of real estate projects, ultimately contributing to the broader economic landscape.

MORE NEWS

February 25, 2026 - 01:36

United Real Estate launches BullseyeAI platformUnited Real Estate has officially launched a new artificial intelligence platform designed to streamline operations for its agents and teams. The innovative system, named BullseyeAI, integrates...

February 24, 2026 - 03:12

Taprooms, Tourism, and Real Estate: What 2026 CRE Trends Mean for Pennsylvania BreweriesPennsylvania`s craft breweries are approaching 2026 balancing significant challenges with emerging opportunities. The industry continues to adapt to evolving consumer drinking habits, persistent...

February 23, 2026 - 20:13

Mortgage rates just dropped below 6%, matching lowest level since 2022In a significant shift for the housing market, average mortgage rates have fallen below the 6% mark, reaching their lowest point since early 2022. This decline offers a welcome respite for...

February 23, 2026 - 09:08

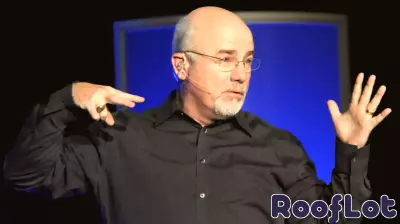

Financial Expert Urges Caution Amid Shifting Mortgage LandscapePersonal finance personality Dave Ramsey is issuing a stark warning to prospective homebuyers, urging a reality check on current mortgage rates and housing market dynamics. He emphasizes that the...