GTJ REIT Inc. Acquires Prime Industrial Site in Southwest Charlotte for $3.85 Million

February 26, 2025 - 10:51

In a significant move for the real estate investment landscape, GTJ REIT Inc. has successfully acquired a 5.4-acre industrial site located in southwest Charlotte for $3.85 million. This strategic purchase highlights the growing demand for industrial spaces in key markets, particularly in areas with robust economic activity.

The site is situated in a prime industrial submarket, making it an attractive asset for future development or leasing opportunities. With Charlotte's economy thriving and its logistics sector expanding, the acquisition positions GTJ REIT Inc. to capitalize on the increasing need for warehouse and distribution facilities.

As e-commerce continues to drive demand for industrial properties, investors are keenly focused on regions that offer favorable conditions for growth. This acquisition not only strengthens GTJ REIT's portfolio but also underscores the ongoing trend of investment in industrial real estate, which remains a resilient sector in the face of changing market dynamics.

MORE NEWS

February 25, 2026 - 01:36

United Real Estate launches BullseyeAI platformUnited Real Estate has officially launched a new artificial intelligence platform designed to streamline operations for its agents and teams. The innovative system, named BullseyeAI, integrates...

February 24, 2026 - 03:12

Taprooms, Tourism, and Real Estate: What 2026 CRE Trends Mean for Pennsylvania BreweriesPennsylvania`s craft breweries are approaching 2026 balancing significant challenges with emerging opportunities. The industry continues to adapt to evolving consumer drinking habits, persistent...

February 23, 2026 - 20:13

Mortgage rates just dropped below 6%, matching lowest level since 2022In a significant shift for the housing market, average mortgage rates have fallen below the 6% mark, reaching their lowest point since early 2022. This decline offers a welcome respite for...

February 23, 2026 - 09:08

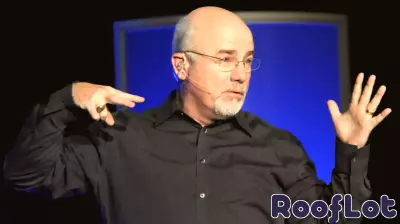

Financial Expert Urges Caution Amid Shifting Mortgage LandscapePersonal finance personality Dave Ramsey is issuing a stark warning to prospective homebuyers, urging a reality check on current mortgage rates and housing market dynamics. He emphasizes that the...