Sticker Shock and Cold Feet Leave Nervous American Homebuyers Adrift

November 1, 2025 - 04:41

In the current housing market, many American homebuyers are facing significant challenges as deals increasingly fall through. The combination of rising interest rates and inflated home prices has created a sense of sticker shock among potential buyers, leading to hesitancy and uncertainty. As buyers grapple with the reality of higher monthly payments, many are reconsidering their decisions, prompting a wave of cancellations and failed transactions.

Real estate professionals report a noticeable uptick in buyers backing out of agreements, often citing financial concerns or a lack of confidence in the market's direction. This trend has left sellers in a precarious position, as they navigate a landscape where offers may not hold up until closing. The uncertainty surrounding the economy, coupled with fluctuating mortgage rates, has only added to the anxiety felt by both buyers and sellers.

As the market continues to evolve, many are left wondering what the future holds for home sales and whether the current climate will stabilize or lead to further disruptions.

MORE NEWS

February 25, 2026 - 01:36

United Real Estate launches BullseyeAI platformUnited Real Estate has officially launched a new artificial intelligence platform designed to streamline operations for its agents and teams. The innovative system, named BullseyeAI, integrates...

February 24, 2026 - 03:12

Taprooms, Tourism, and Real Estate: What 2026 CRE Trends Mean for Pennsylvania BreweriesPennsylvania`s craft breweries are approaching 2026 balancing significant challenges with emerging opportunities. The industry continues to adapt to evolving consumer drinking habits, persistent...

February 23, 2026 - 20:13

Mortgage rates just dropped below 6%, matching lowest level since 2022In a significant shift for the housing market, average mortgage rates have fallen below the 6% mark, reaching their lowest point since early 2022. This decline offers a welcome respite for...

February 23, 2026 - 09:08

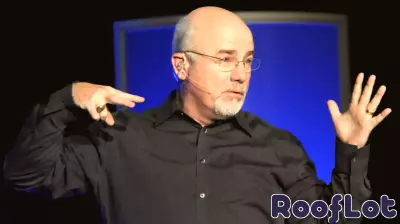

Financial Expert Urges Caution Amid Shifting Mortgage LandscapePersonal finance personality Dave Ramsey is issuing a stark warning to prospective homebuyers, urging a reality check on current mortgage rates and housing market dynamics. He emphasizes that the...